Predicting Yuan Is All About Fed as Basket Confounds Strategists

Yuan forecasters are struggling to agree on how China’s central bank would respond to a stronger dollar.

That helps explain why predictions for the yuan against a basket of peers for the rest of 2016 range from a gain of 5.6 percent to a drop of 12 percent in a Bloomberg survey of 20 strategists and traders.

The results reflect the dilemma facing China’s central bank if the Federal Reserve raises interest rates, spurring gains in the U.S. currency. Allow the yuan to rise with the greenback and China eases fears of devaluation at the expense of the nation’s exporters. Permit further losses against the trade-weighted basket, and it risks spurring destabilizing outflows.

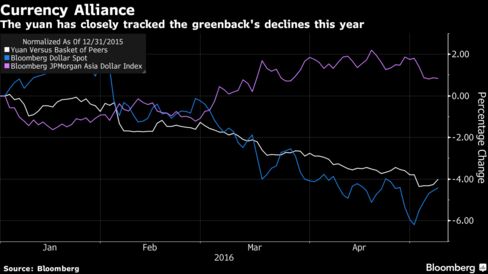

Since January, China’s policy makers had it easy as the yuan tracked the dollar lower, giving outbound shipments a competitive edge against rivals such as Japan and providing the appearance of steadiness. Now the greenback is reversing, jumping Monday to cap a 2.3 percent five-day advance, its biggest in a year.

“If the dollar goes up and rallies a whole lot, then it’s going to re-inject, very quickly, a degree of instability into the exchange-rate regime in China," said Ray Farris, Singapore-based managing director and head of Asia macro strategy at Credit Suisse Group AG. "Most of the reason why the exchange rate market and capital flows have stabilized is not because things in China are a lot better in a macroeconomic level, it’s simply because the dollar weakened."

The CFETS RMB Index will end the year at 97, virtually unchanged from 96.61 on Friday, according to the median of forecasts in the Bloomberg survey conducted in late April.

Royal Bank of Canada says China’s authorities have little choice but to let the yuan weaken.

“You have to ask yourself -- when the macro story is pointing one way, where do you expect the currency to go?" said Sue Trinh, Hong Kong-based head of Asian foreign-exchange strategy at Royal Bank of Canada, who expects the index to drop to 85 by the year-end. "It is in China’s interest to depreciate the yuan against everything, and that also includes the dollar."

The greenback is rebounding after its worst quarter since 2010 on speculation the Fed is still on course to raise borrowing costs this year, even amid signs of slowing growth in the labor market. While the yuan is little changed against the greenback in 2016, it has slumped 4.3 percent against a trade-weighted basket.

The onshore yuan was little changed at 6.5142 a dollar as of 4:58 p.m. in Shanghai on Tuesday, while the offshore rate in Hong Kong was steady at 6.5414. A Bloomberg replica of the CFETS index advanced for a fifth day to 97.03.

Slowing Economy

The most recent Chinese economic data suggest a pickup in March didn’t carry through to last month. Manufacturing gauges trailed estimates, while the nation’s exports fell 1.8 percent from a year earlier in April, after increasing 11.5 percent in the previous month. Economic growth will slow this year to a quarter-century low of 6.5 percent, according to a separate Bloomberg survey.

Moves in currencies that are part of China’s foreign-exchange reserves helped the stockpile swell by a surprise $7 billion in April, according to a note from Goldman Sachs Group Inc. economists. Adjusted for estimated valuation effects, the reserves would have decreased by $6 billion, they said.

Shock Devaluation

This year’s declines against the basket go against pledges by the central bank to keep the currency stable on a trade-weighted basis. The authorities have focused on restoring calm after spooking investors with a shock devaluation last August and subsequent turmoil that shook confidence in the ability of the nation’s leaders. An estimated $1 trillion of capital fled China last year, while the monetary authority burned through $513 billion of its foreign-exchange reserves as it propped up the yuan.

For Roy Teo, a senior currency strategist at ABN Amro Bank, China’s policy makers are trying to avoid giving traders any ammunition in terms of currency direction.

“The People’s Bank of China doesn’t want to be too obvious in terms of what it prefers, as then it would result in speculative flows front-running the central bank’s objective,” Teo said from Singapore. “The yuan’s moves versus the dollar and the basket have been gradual, so as long as it’s generally stable, it’s unlikely to impact business. But if the dollar strengthens and China continues to depreciate the yuan basket, there would be a credibility issue.”

The participants in the Bloomberg survey included ABN Amro, HSBC, Natixis, Royal Bank of Canada, DBS Bank Ltd., Banco Bilbao Vizcaya Argentaria, Scotiabank, Guangdong Nanyue Bank, China Citic Bank International Ltd., China Merchants Securities, Nanyang Commercial Bank and China Merchants Bank. Eight strategists and traders asked not to be named as they are not allowed to comment on the foreign-exchange market publicly.