BENEFICIAL OWNERSHIP IDENTIFICATION TOOL

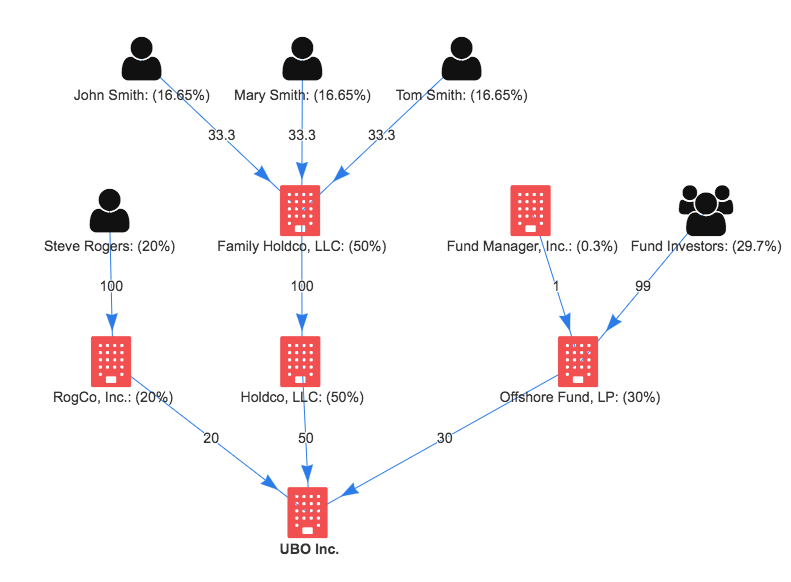

The identity of the real owners – the ‘beneficial owners’ – of the companies that have obtained rights to extract oil, gas and minerals is often unknown, hidden by a chain of unaccountable corporate entities. This problem also affects other sectors and often helps to feed corruption and tax evasion. People who live in resource-rich countries are at particular risk of losing out as extractive assets are too often misallocated for corrupt reasons. Definition of beneficial ownership: i. A beneficial owner in respect of a company means the natural person(s) who directly or indirectly ultimately owns or controls the corporate entity. ii.The multi-stakeholder group should agree an appropriate definition of the term beneficial owner. The definition should be aligned with (f)(i) above and take international norms and relevant national laws into account, and should include ownership threshold(s). The definition should also specify reporting obligations for politically exposed persons. iii.Publicly listed companies, including wholly-owned subsidiaries, are required to disclose the name of the stock exchange and include a link to the stock exchange filings where they are listed. iv.In the case of joint ventures, each entity within the venture should disclose its beneficial owner(s), unless it is publicly listed or is a wholly-owned subsidiary of a publicly listed company. Each entity is responsible for the accuracy of the information provided. Determination of Beneficial Owner (a) A beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (1) Voting power which includes the power to vote, or to direct the voting of, such security; and/or, (2) Investment power which includes the power to dispose, or to direct the disposition of, such security. (b) Any person who, directly or indirectly, creates or uses a trust, proxy, power of attorney, pooling arrangement or any other contract, arrangement, or device with the purpose of effect of divesting such person of beneficial ownership of a security or preventing the vesting of such beneficial ownership as part of a plan or scheme to evade the reporting requirements of the regulatory. (c) All securities of the same class beneficially owned by a person, regardless of the form which such beneficial ownership takes, shall be aggregated in calculating the number of shares beneficially owned by such person. (d) Notwithstanding the provisions of paragraphs (a) and (c) of this rule: (1) (i) A person shall be deemed to be the beneficial owner of a security, subject to the provisions, if that person has the right to acquire beneficial ownership of such security within sixty days, including but not limited to any right to acquire: (A) Through the exercise of any option, warrant or right; (B) through the conversion of a security; (C) pursuant to the power to revoke a trust, discretionary account, or similar arrangement; or (D) pursuant to the automatic termination of a trust, discretionary account or similar arrangement, any person who acquires a security with the purpose or effect of changing or influencing the control of the issuer, or in connection with or as a participant in any transaction having such purpose or effect, immediately upon such acquisition shall be deemed to be the "beneficial owner" of the securities which may be acquired through the exercise or conversion of such security or power. Any securities not outstanding which are subject to such options, warrants, rights or conversion privileges shall be deemed to be outstanding for the purpose of computing the percentage of outstanding securities of the class owned by such person but shall not be deemed to be outstanding for the purpose of computing the percentage of the class by any other person. (ii) A person who in the ordinary course of his business is a pledgee of securities under a written pledge agreement shall not be deemed to be the beneficial owner of such pledged securities until the pledgee has taken all formal steps necessary which are required to declare a default and determines that the power to vote or to direct the vote or to dispose or to direct the disposition of such pledged securities will be exercised, provided, that: (iii) The pledgee agreement is bona fide and was not entered into with the purpose nor with the effect of changing or influencing the control of the issuer, nor in connection with any transaction having such purpose or effect, including any transaction; (iv) The pledgee agreement, prior to default, does not grant to the pledgee; Oil, gas and mining projects can yield great profits both to extractive companies and governments. In many cases such projects are run by responsible companies with the necessary technical and financial capacity. However, experience has unfortunately also shown that in many cases, in particular where governance is weak, rights to extract oil and minerals may be given to companies that do not have such competence. Rather, such companies may be given access to lucrative extractive projects because their owners are politically connected, or because their owners are willing to engage in questionable deals aimed at generating quick profits for a few rather than benefits for wider society. Suspicion or confirmed wrongdoing can lead to devaluation of other extractive assets, and deter overall investment in countries rich in natural resources. Anonymous companies make it harder to curb money laundering and corruption as it enables wrongdoers to hide behind a chain of companies often registered in multiple jurisdictions. It has been estimated that developing countries lose USD 1 trillion each year as a result of corrupt or illegal deals, many of which involve anonymous companies. In 2013, the Africa Progress Panel suggested that the Democratic Republic of theCongo (DRC) in the period 2010-2012 lost at least USD 1.36 billion from five mining deals hidden behind a structure of complex and secret company ownership. According to DRC’s EITI Reports, this is about the same as the country’s average annual revenue from oil, gas and mining in the same time period. Disclosure of beneficial ownership will help lower the risk of financial misconduct. The Panama Papers confirm that persons behind oil, gas and mineral extraction may well hide behind shell companies. Attention on closing down the possibilities for hiding money in places like Panama is welcome. But it will not alone put an end to financial secrecy facilitating tax dodging and corruption. It has to be matched with better rules and enforcement in countries where the money is generated in the first place, which is why EITI’s new ownership requirements are so important. The benefits of beneficial ownership transparency are numerous. It can help improve the investment climate, reduce reputational and financial risks, prevent corruption and illicit financial flows, improve the rule of law, increase trust and accountability, and enhance revenue collection. The expectations placed on banks’ boards and their compliance officers are intense and rising. They are expected to ensure their organisations meet their own high internal compliance standards and then apply the same level of rigour to their counterparties’ compliance standards. In an increasingly global economy, the complexity of transactions is increasing as fast as the demand for transparency. Amid all the fines and regulatory action a dominant theme has emerged: do you know who is behind the organisation you are doing business with? Who ultimately controls your counterparty or your counterparty’s counterparty? What are their connections or other interests? First line of defence Banks now find themselves at the front line of cultural expectation: whether it be their employees or consumers or wider society, people want to see an end to drug trafficking, human trafficking, corruption, terrorism, tax evasion and arms dealing. Banks are seen as one of the first lines of defence by the authorities as they seek to recover funds, interrupt their flow or trace their source. Regulators worldwide now require banks to identify the ultimate beneficial owners (UBO) of the organisations they do business with, setting the threshold of ownership at 25%, 10% or even lower. But banks are struggling to meet this requirement and find themselves behind the regulatory curve. They are helped by improving technology and ever-increasing amounts of data available online. But while data volumes raise the bar in terms of what constitutes ‘best efforts’ in discovering UBO, the challenge extends beyond what banks knew to what they could and should have known at the time. And knowing what you don’t know is equally important in our view. In terms of acquiring beneficial ownership information, we have seen a wide range of techniques and databases used. One flaw we have seen in some banks is that they conduct entity due diligence separately from their beneficial owner due diligence. Our best pracrice recommendation is to keep the related entities, officers, directors and beneficial owners together in the same investigation with the customer or counterparty being vetted. Beneficial Ownership–Regulatory Highlights Patriot Act (USA Patriot Act): The final rules similarly provide that, based on a financial institution’s risk assessment of a new account opened by a customer that is not an individual, a financial institution may need to take additional steps to verify the identity of the customer by seeking information about individuals with ownership control over the account, including signatories. FinCEN: On Feb. 29, 2012, FinCEN issued an ANPR (Advance Notice of Proposed Rulemaking) seeking comments on a proposed CDD regulation that would explicitly require covered financial institutions to institute defined programs to identify the real or beneficial ownership of accountholders. FinCEN noted in its ANPR that there currently are two limited circumstances (concerning private bank accounts and correspondent accounts) in which financial institutions are expressly required to obtain beneficial ownership information, and that it is considering expanding the explicit requirement to obtain beneficial ownership information to all customers. FATCA: The Internal Revenue Service has published a draft of Form W-8BEN-E, which overseas entities must use to certify beneficial ownership status for US withholding tax purposes under the Foreign Account Tax Compliance Act. Depending on which of the 22 different descriptions that they correspond to in Part 1, which deals with the identification of the beneficial owner, entities are directed to different sections of the 25-part document. FATF: “Identifying the beneficial owner, and taking reasonable measures to verify the identity of the beneficial owner, such that the financial institution is satisfied that it knows who the beneficial owner is. For legal persons and arrangements this should include financial institutions understanding the ownership and control structure of the customer.” Moreover, online data is fragmented, unreliable and often out of date. Criminals are becoming more adept at covering their tracks using data protection laws to clean up their online presence. Holdings in banks may be dispersed among numerous entities that fall below the regulatory threshold. Compliance woes mount Compliance is becoming increasingly stressful for individuals and costly for banks. Compliance officers face not only impossible workloads but the threat of personal liability, fines, career damage or even imprisonment. Already we are seeing the unintended consequences of this, as compliance professionals leave the industry. Banks and financial institutions not only face the risk of fines but also the loss of reputation, and these risks are matched by the rising cost of compliance. Banks have tried to meet their compliance requirements by hiring more and more compliance staff but the problems haven’t gone away and the cost of compliance has become prohibitive. Some banks have responded by withdrawing from whole regions.or terminating risky relationships, raising the prospect of unbanked nations. Often this has rebounded on banks as they are perceived as acting in a heavy handed or even discriminatory manner. And the irony is that banks derisking in this way only make it easier for criminals to launder money through illicit channels. On August 28, 2017 Habib Bank issued a statement addressed to the General Manager, Pakistan Stock Exchange Limited in Karachi disclosing it's intention to close it's New York Branch due to hefty fine imposed by the New York State Department of Financial Services (DFS) nearly USD 630 million for failing to comply with the state federal laws and for failing to set policies and procedures to detect and prevent illicit money transfers, including screening customers and reporting suspicious transactions to regulators, knowing that New York State passed strict anti-money laundering regulations in 2015, such as requiring a bank's chief compliance officer to certify whether it upholds the systems outlined in the rule. The lack of trust based on lack of knowledge also hurts banks’ business on a day to day basis: the need to establish ownership slows down and disrupts a bank’s ability to form new trading relationships. They may have to walk away from or lose a promising counterparty relationship because they simply cannot establish who they are ultimately dealing with – the UBO. They may have to route transactions through a larger number of trusted intermediaries and bear the increased cost. How do banks discover UBO? When a bank wants to form a new relationship with a counterparty, particularly if it is in a new country or territory, discovering the ultimate beneficial owner of a bank can be more like detective work, but compliance officers in banks have many sources of information. Typically a bank will follow the guidelines laid down by the Wolfsberg Group around correspondent banking and counterparty relationships. When entering a new territory banks will look for the top 5 banks and assess their performance based on financials; they will check history to see everything was in order; and perform other research before they decide which counterparty to proceed with (based on the cost of doing business, preferential rights, charges, etc). When a bank has decided to work with a counterparty bank, it needs data on the counterparty’s location, registered address, contact details, senior personnel (such as board members and compliance officers), and other senior people they may need to contact. The bank will need to look at financials, performance, auditor’s reports and regulatory information, such as, is the counterparty compliant? Does it have the required documentation? They will also need detailed ownership information up to the ultimate parent or individual UBO. Could there be a better way? For a long time I have wanted to create a KYC tool that not only helped visualize complicated ownership structures, but also calculated ownership percentages across multiple levels expanding client base, feature that determines the percentage owned of the target company through each parent company back to the individual owners. This is the approach many KYC groups currently use to calculate ownership percentages to meet the new CDD rules. How does it work? The calculated percentage will appear in parenthesis next to every parties’ name, allowing users to easily identify which individual owners have the most control. What does the future look like? In our view, with better information and a clearer view of ownership structures, banks can make better and faster decisions about where and who they do business with. They can refine their attitude to high-risk entities and avoid blanket policies while knowing what they do and don’t need to be aware of. Furthermore, they can demonstrate to the regulators that their decisions were sound and reflected not only their best efforts at discovering UBO, but best practice in due diligence. Accuity is innovating its solutions to deliver this new level of ownership data, including: • data validated directly with banks • UBO information connected to data identifying heightened risk in order to fulfil compliance checks eg PEPs • audit trail showing regulators when and how decisions were made and on what information • live data and visualisation When banks and financial institutions have this level of ownership information they will find they can onboard and review entities faster, so that they can start doing business earlier, or quickly reject unsuitable partners. Or they can quickly decide not to get involved in a compliance process which may prove too lengthy or ultimately inconclusive. For compliance officers and MLRO it will mean a faster decision-making process, with decisions supported with hard factual data, intuition replaced with evidence, and manually compiled reports replaced with accurate and powerful online live data. Is there a catch? Nope, no catch. Go nuts with it. Over the course of my career I have conducted KYC reviews on thousands of companies, and this is a tool that I always wished existed, so I am happy to be in a position where I can help make it a reality for all of the AML/KYC analysts who have to do this work everyday. Hope that you find it useful, and it makes your job of identifying beneficial ownership a little easier.The challenge with hidden ownership in Oil and Gas Projects

Even when new clients are cooperative about providing ownership information during onboarding, there are many cases when there is just no simple way to understand the ownership structure without breaking out the calculator and charting it on paper.

Even when new clients are cooperative about providing ownership information during onboarding, there are many cases when there is just no simple way to understand the ownership structure without breaking out the calculator and charting it on paper.