Understanding Back-To-Back Letters of Credit Laundering Risks

Bachir El Nakib, Senior Consultant, Compliance Alert (LLC)

Letter of Credit

A credit instrument issued by a bank that guarantees payments on behalf of its customer to a third party when certain conditions are met. Letters of Credit (L/Cs) are commonly used to finance exports. Exporters want assurance that the ultimate buyer of its goods will make payment, and this is given by the buyer’s purchase of a bank letter of credit. The L/C is then forwarded to a correspondent bank in the city in which the payment is to be made. The L/C is drawn on when the goods are loaded for shipping, received at the importation point, clear customs and are delivered. L/Cs can be used to facilitate money laundering by transferring money from a country with lax exchange controls, thus assisting in creating the illusion that an import transaction is involved. L/Cs can also serve as a façade when laundering money through the manipulation of import and export prices. Another laundering use for L/Cs is in conjunction with wire transfers to bolster the legitimate appearance of non- existent trade transactions.

Purpose

The purpose is to provide a general understanding of letters of credit, their use and application. The topics covered are the following:

- General background information;

- Types of letters of credit;

- Common problems with letters of credit;

- Procedures for establishing letters of credit;

- Amendments; and

- General tips to both buyers and sellers.

In addition, attachments to this document detail a step-by-step letter of credit procedures.

Definition

Letters of credit are commonly used to reduce credit risk to sellers in both domestic and international sales arrangements. By having a bank issue a letter of credit, in essence, one is substituting the bank's credit worthiness for that of the customer.

Types: There are two basic forms of letters of credit:

- Standby L/C, and

- Documentary L/C,

Documentary letters of credit can be either Revocable or Irrevocable, although the first is extremely rare. Irrevocable letters of credit can be Confirmed or Not Confirmed. Each type of credit has advantages and disadvantages for the buyer and for the seller, which this information will review below. Charges for each type will also vary. However, the more the banks assume risk by guaranteeing payment, the more they will charge for providing the service.

Documentary Revocable Letter of Credit

Revocable credits may be modified or even canceled by the buyer without notice to the seller. Therefore, they are generally unacceptable to the seller.

Documentary Irrevocable Letter of Credit

This is the most common form of credit used in international trade. Irrevocable credits may not be modified or canceled by the buyer. The buyer's issuing bank must follow through with payment to the seller so long as the seller complies with the conditions listed in the letter of credit. Changes in the credit must be approved by both the buyer and the seller. If the documentary letter of credit does not mention whether it is revocable or irrevocable, it automatically defaults to irrevocable. See Credit Administration, Sample Procedure for Administration of a Documentary Irrevocable Letters of Credit for a systematic procedure for establishing an irrevocable letter of credit.

There are two forms of irrevocable credits:

Unconfirmed credit (the irrevocable credit not confirmed by the advising bank)

In an unconfirmed credit, the buyer's bank issuing the credit is the only party responsible for payment to the seller. The seller's advising bank pays only after receiving payment from the issuing bank. The seller's advising bank merely acts on behalf of the issuing bank and, therefore, incurs no risk.

Confirmed credit (the irrevocable confirmed credit)

In a confirmed credit, the advising bank adds its guarantee to pay the seller to that of the buyer's issuing bank. Once the advising bank reviews and confirms that all documentary requirements are met, it will pay the seller. The advising bank will then look to the issuing bank for payment. Confirmed Irrevocable letters of credit are used when trading in a high-risk area where war or social, political, or financial instability are real threats. Also common when the seller is unfamiliar with the bank issuing the letter of credit or when the seller needs to use the confirmed letter of credit to obtain financing its bank to fill the order. A confirmed credit is more expensive because the bank has added liability.

Standby Letter of Credit

This credit is a payment or performance guarantee used primarily in the United States. They are often called non-performing letters of credit because they are only used as a backup should the buyer fail to pay as agreed. Thus, a stand-by letter of credit allows the customer to establish a rapport with the seller by showing that it can fulfill its payment commitments. Standby letters of credit are used, for example, to guarantee repayment of loans, to ensure fulfillment of a contract, and to secure payment for goods delivered by third parties. The beneficiary to a standby letter of credit can cash it on demand. Stand-by letters of credit are generally less complicated and involve far less documentation requirements than irrevocable letters of credit. See Credit Administration, Sample Procedure for Administration of a Standby Letter of Credit for a systematic procedure for establishing a standby letter of credit.

Special Letters of Credit

The following is a brief description of some special letters of credit.

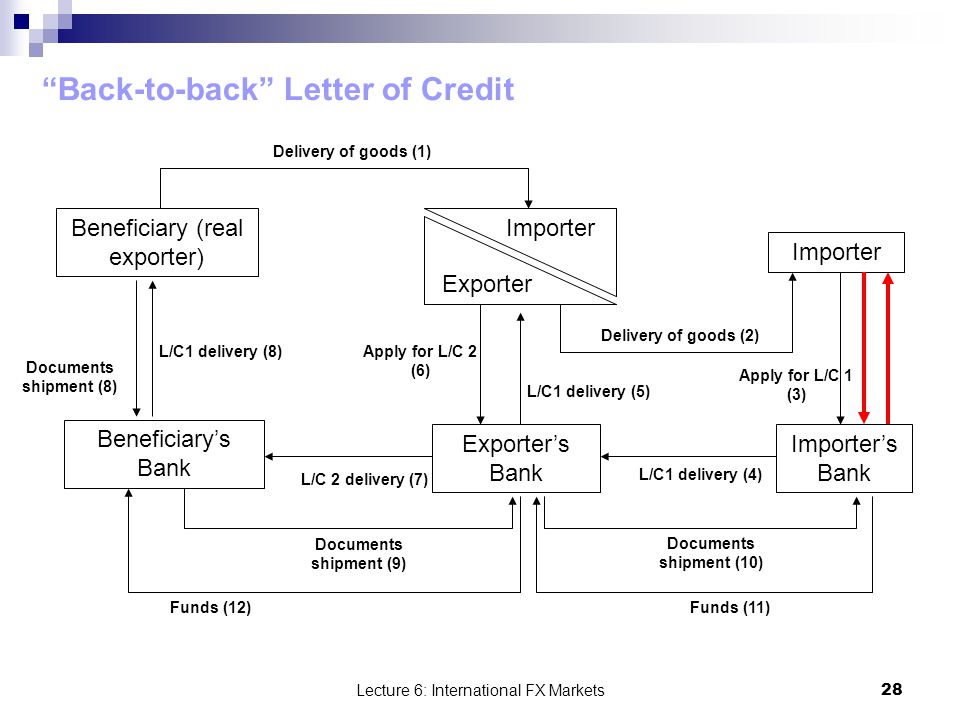

Back-to-Back Letter of Credit

This is a new letter of credit opened based on an already existing, non-transferable credit used as collateral. Traders often use back-to-back arrangements to pay the ultimate supplier. A trader receives a letter of credit from the buyer and then opens another letter of credit in favor of the supplier. The first letter of credit serves as collateral for the second credit.

The first letter of credit would constitute the collateral for the second letter of credit. This arrangement is often called a back-to-back letter of credit, which is also sometimes called primary and secondary letters of credit, a mother and baby letter of credit, or a master and secondary letter of credit.

Deferred Payment (Usance) Letter of Credit

In Deferred Payment Letters of Credit, the buyer accepts the documents related to the letter of credit and agrees to pay the issuing bank after a fixed period. This credit gives the buyer a grace period for payment.

Red Clause Letter of Credit

Red Clause Letters of Credit provide the seller with cash prior to shipment to finance production of the goods. The buyer's issuing bank may advance some or all of the funds. The buyer, in essence, extends financing to the seller and incurs the risk for all advanced credits.

Revolving Letter of Credit

With a Revolving Letter of Credit, the issuing bank restores the credit to its original amount once it has been used or drawn down. Usually, these arrangements limit the number of times the buyer may draw down its line over a predetermined period.

Transferable Letter of Credit

This type of credit allows the seller to transfer all or part of the proceeds of the original letter of credit to a second beneficiary, usually the ultimate supplier of the goods. The letter of credit must clearly state that it is transferable for its to be considered as such. This is a common financing tactic for middlemen and is common in MENA region and East Asia.

Assignment of Proceeds

The beneficiary of a letter of credit may assign all or part of the proceeds under a credit to a third party (the assignee). However, unlike a transferred credit, the beneficiary maintains sole rights to the credit and is solely responsible for complying with its terms and conditions. For the assignee, an assignment only means that the paying bank, once it receives notice of the assignment, undertakes to follow the assignment instructions, if and when payment is made. The assignee is dependent upon the beneficiary for compliance, and thus this arrangement is riskier than a transferred credit. Before agreeing to an assignment of proceeds arrangement, the assignee should carefully review the original letter of credit.

Common Problems with Letters of Credit

Most problems result from the seller's inability to fulfil obligations stated in the letter of credit. The seller may find these terms difficult or impossible to fulfill and, either tries to fulfil them and fails, or asks the buyer to amend to the letter of credit. As most letters of credit are irrevocable, amendments may at times be difficult since both the buyer and the seller must agree.

Sellers may have one or more of the following problems:

- The shipment schedule cannot be met;

- The stipulations concerning freight costs are unacceptable;

- The price becomes too low due to exchange rates fluctuations;

- The quantity of product ordered is not the expected amount;

- The description of product is either insufficient or too detailed; and,

- The stipulated documents are difficult or impossible to obtain.

Even when sellers accept the terms of a letter of credit, problems often arise late in the process. When this occurs, the buyer's and seller's banks will try to negotiate any differences. In some cases, the seller can correct the documents and present them within the time specified in the letter of credit. If the documents cannot be corrected, the advising bank will ask the issuing bank to accept the documents despite the discrepancies found. It is important to note that, if the documents are not in accord with the specifications of the letter of credit, the buyer's issuing bank is no longer obligated to pay.

Basic Procedures for Establishing a Letter of Credit

The letter of credit process has been standardized by a set of rules published by the International Chamber of Commerce (ICC). These rules are called the Uniform Customs and Practice for Documentary Credits (UCP) and are contained in ICC Publication No. 600. The following is the basic set of steps used in a letter of credit transaction. Specific letter of credit transactions follow somewhat different procedures.

1. After the buyer and seller agree on the terms of a sale, the buyer arranges for his bank to open a letter of credit in favor of the seller. Note: The buyer will need to have a line of credit established at the bank or provide cash collateral for the amount of the letter of credit.

2. The buyer's issuing bank prepares the letter of credit, including all of the buyer's instructions to the seller concerning shipment and required documentation.

3. The buyer's bank sends the letter of credit to the seller's advising bank.

4. The seller's advising bank forwards the letter of credit to the seller.

5. The seller carefully reviews all conditions stipulated in the letter of credit. If the seller cannot comply with any of the provisions, it will ask the buyer to amend the letter of credit.

6. After final terms are agreed upon, the seller ships the goods to the appropriate port or location.

7. After shipping the goods, the seller obtains the required documents. Please note that the seller may have to obtain some documents prior to shipment.

8. The seller presents the documents to its advising bank along with a draft for payment.

9. The seller's advising bank reviews the documents. If they are in order, it will forward them to the buyer's issuing bank. If a confirmed letter of credit, the advising bank will pay the seller (cash or a bankers' acceptance).

10. Once the buyer's issuing bank receives and reviews the documents, it either (1) pays if there are no discrepancies; or (2) forwards the documents to the buyer if there are discrepancies for its review and approval.

Opening a Letter of CreditLevel of Detail

The wording in a letter of credit should be simple, but specific. The more detailed an L/C is, the more likely the seller will reject it as too difficult to fulfill. At the same time, the buyer will wish to define in detail what its is paying for.

Type of Credit

Letters of credit used in trade are usually either irrevocable unconfirmed credits or irrevocable confirmed credits. In choosing which type to open both the seller and the buyer should consider the generally accepted payment processes in each country, the value and demand for the goods, and the reputation of the buyer and seller.

Documents

In specifying required documents, it is very important to include those required for customs and those reflecting the agreement reached between the buyer and the seller. Required documents usually include the bill of lading, a commercial and/or consular invoice, the bill of exchange, the certificate of origin, and the insurance document. Other documents required may be an inspection certificate, copies of a cable sent to the buyer with shipping information, a confirmation from the shipping company of the state of its ship, and a confirmation from the forwarder that the goods are accompanied by a certificate of origin. Prices should be stated in the currency of the letter of credit and documents should in the same language as the letter of credit.

The Letter of Credit Application

The following information should be addressed when establishing a letter of credit.

1. Beneficiary

The seller should provide to the buyer its full corporate name and correct address. A simple mistake here may translate to inconsistent or improper documentation at the other end.

2. Amount

The seller should state the actual amount of the letter of credit. One can request a maximum amount when there is doubt as to the actual count or quantity of the goods. Another option is to use words like "approximate", "circa", or "about" to indicate an acceptable 10 % plus or minus from the stated amount. For consistency, if you use this wording you will need to use it also in connection with the quantity.

3. Validity

The seller will need time to ship and to prepare all the necessary documents. Therefore, the seller should ensure that the validity and period for document presentation after the shipment of the goods is long enough.

4. Seller's Bank

The seller should list its advising bank as well as a reimbursing bank if applicable. The reimbursing bank is the local bank appointed by the issuing bank as the disbursing bank.

5. Type of Payment Availability

The buyer and seller may agree to use sight drafts, time drafts, or some sort of deferred payment mechanism.

6. Desired Documents

The buyer specifies the necessary documents. Buyers can list, for example, a bill of lading, a commercial invoice, a certificate of origin, certificates of analysis, etc. The seller must agree to all documentary requirements or suggest an amendment to the letter of credit.

7. Notify Address

This is the address to notify upon the imminent arrival of goods at the port or airport of destination. A notification listing damaged goods is also sent to this address, if applicable.

8. Description of Goods

The seller should provide a short and precise description of the goods as well as the quantity involved. Note the comments in step #2 above concerning approximate amounts.

9. Confirmation Order

With international arrangements, the seller may wish to confirm the letter of credit with a bank in its country.

Amendment of a Letter of Credit

For the seller to change the terms noted on an irrevocable letter of credit, it must request an amendment from the buyer.

The amendment process is as follows:

- The seller requests a modification or amendment of questionable terms in the letter of credit;

- If the buyer and issuing bank agree to the changes, the issuing bank will change the letter of credit;

- The buyer's issuing bank notifies the seller's advising bank of the amendment; and

- The seller's advising bank notifies the seller of the amendment.

Tips for Buyers and Sellers

Seller

1. Before signing a sales contract, the seller should make inquiries about the buyer's creditworthiness and business practices. The seller's bank will generally assist in this investigation.

2. In many cases, the issuing bank will specify the advising and/or confirming bank. These designations are usually based on the issuing bank's established correspondent relationships. The seller should ensure that the advising/confirming bank is a financially sound institution.

3. The seller should confirm the good standing of the buyer's issuing bank if the letter of credit is unconfirmed.

4. For confirmed letters of credit, the seller's advising bank should be willing to confirm the letter of credit issued by the buyer's bank. If the advising bank refuses to do so, the seller should request another issuing bank as the current bank may be or is in the process of becoming insolvent.

5. The seller should carefully review the letter of credit to ensure its conditions can be met. All documents must conform to the terms of the letter of credit. The seller must comply with every detail of the letter of credit specifications; otherwise the security given by the credit is lost.

6. The seller should ensure that the letter of credit is irrevocable.

7. If amendments are necessary, the seller should contact the buyer immediately so that the buyer can instruct the issuing bank to make the necessary changes quickly. The seller should keep the letter of credit's expiration date in mind throughout the amendment process.

8. The seller should confirm with the insurance company that it can provide the coverage specified in the letter of credit and that insurance charges listed in the letter of credit are correct. Typical insurance coverage is for CIF (cost, insurance and freight) often the value of the goods plus about 10 percent.

9. The seller must ensure that the goods match the description in the letter of credit and the invoice description.

10. The seller should be familiar with foreign exchange limitations in the buyer's country that could hinder payment procedures.

Buyer

1. When choosing the type of letter of credit, the buyer should consider the standard payment methods in the seller's country.

2. The buyer should keep the details of the purchase short and concise.

3. The buyer should be prepared to amend or re-negotiate terms of the letter of credit with the seller. This is a common procedure in international trade. With irrevocable letters of credit, the most common type, all parties must agree to amend the document.

4. The buyer can reduce the foreign exchange risk by buying forward currency contracts.

5. The buyer should use a bank experienced in foreign trade as its issuing bank.

6. The validation time stated on the letter of credit should give the seller ample time to produce the goods or to pull them out of stock.

7. A letter of credit is not fail-safe. Banks are only responsible for the documents exchanged and not the goods shipped. Documents in conformity with the letter of credit specifications cannot be rejected on grounds that the goods were not delivered as specified in the contract. The goods shipped may not in fact be the goods ordered and paid for.

8. Purchase contracts and other agreements pertaining to the sale between the buyer and seller are not the concern of the issuing bank. Only the letter of credit terms are binding on the bank.

9. Documents specified in the letter of credit should include those the buyer requires for customs clearance.

After receiving the irrevocable L/C , Sometimes exporters of services and goods, request for opening one or more back to back L/Cs . In such negotiation two separate L/C are used and using of it is necessary when the main beneficiary is not able to provide goods and for many other reasons , namely , first beneficiary is not willing to disclose the name of his buyer to the second beneficiary, beneficiary does not accept to transfer the L/C due to the high risk, the main L/C currency differs with the currency of buying the goods by the first beneficiary from the producer ( second beneficiary), first beneficiary intends to purchase from second beneficiary in a price lower than the first L/C amount and to sell for first L/C price to the first L/C buyer. In such cases it is necessary to use back to back L/Cs. So, in order to issue back to back L/C, first beneficiary requests for issuing the second L/C.

Conditions and important notes which are considered and observed in the time of second L/C opening are as follows :

1) Second L/C opening is the subject which is only related to beneficiary and second L/C issuing bank and it is not necessary that the issuing bank of first L/C or first applicant be aware or agree with the case.

2) Maximum FX amount limit and second L/C currency will be upto 90 percent of first L/C amount .

3) First L/C and back to back L/C conditions such as goods and required documents and …must suit each other.

4) Expiry date of back to back L/C must be at least 15 days prior to first L/C expiry date and at most one week after the latest shipment date.

5) After issuing the second L/C , the bank may only accept those amendments of the first L/C of the issuing bank’s Correspondent which are relevant to conditions of both L/Cs and the request for full cancellation of the first L/C is subject to the full cancellation of the second L/C and agreement of the Second beneficiary within the validity of the L/C.

6) Opening back to back L/C is done taking into consideration the client's credit worthiness ( beneficiary of the first L/C ) , obtaining enough security and carrying out the required processes in the relevant Credit Commission in accordance with the specified ceilings and Uniform Customs and Practice For Documentary Letters of Credit against ‘mosharekat-e-madani’ contract in FX currency.

7) In case back to back L/C is used for import of the goods from outside of the country or Free Zones , implementation of all processes of order registration , obtaining relevant licenses and observation of the circulars relevant to the import of the goods are obligatory .

Processes of Back to Back LC:

1- Receipt of the Export L/C for which BSI is advising and negotiating bank .

2- Review of the issuing bank's credit worthiness.

3- Advising the L/C to the first beneficiary .

4- Receipt of the first beneficiary's request for issuing the back to back L/C based on the Export L/C.

5- Obtaining the authorization from Export Section of FX Operations Department for issuance of the back to back LC.

6- Implementation of L/C issuing processes such as obtaining Credit Commission's approval relevant to the specified ceilings complying with Uniform Customs and Practice for Documentary Letters of credit and filling in the form No 508 , undertaking form and other documents related to the letter of credit.

7- Receipt of the specified advance payment and other charges from the applicant .

8- Issuing the back to back L/C.

Trigger Events

There may be trigger events during the onboarding stage or during the ongoing review of a relationship or during the transaction process if any additional risk factors become apparent, and this may warrant additional or enhanced due diligence which may include third parties (i.e., parties not associated with Bank A, intermediaries or traders using back-to-back or transferable DCs to unconnected other parties).

Bank B due diligence

- A should undertake appropriate due diligence on B, depending on the nature of the relationship between A and B.

- The due diligence will support a continuing relationship with B, which will be subject to a relevant risk-based review cycle.

Reviewing transactional information

Reviewing and screening will take place at:

- receipt of the initial D/C application (and any amendments) from X;

- receipt and checking of documents presented by Y through B;

- payment;

- other times where material changes to the transaction occur.

In practice, once a D/C has been issued, A has an obligation to complete the transaction. Only if subsequent reviewing activity shows a positive screening match would Bank A be in a position to stop the transaction.

Fraud and D/Cs

Depending on local law there may be circumstances where fraud would also allow the transaction to be stopped. The documentation presented to Bank A will be examined to ensure compliance with the DC and in accordance with the ICC UCP 600 and international banking standards.

Reviewing the application

This includes sanctions and terrorist lists for:

- Y as a named target;

- Y's country;

- the goods;

- the shipment country;

- transshipment points and destination points;

- all other names in the D/C;

- the countries which are rated as high-risk for other reasons in which B or Y are located or the transportation of goods occurs.

Case Study: ING Bank, N.V.

A Settlement Agreement was released in June 2012 by the United States Department of the Treasury regarding the voluntary self-disclosure to the Office of Foreign Assets Control (OFAC) by ING Bank, N.V. (ING Bank), a financial institution registered and organized in the Netherlands. The violations of numerous sanctions programs imposed by the United States against Cuba, Burma, the Sudan, Libya and Iran were determined by the Americans as “egregious.” The total settlement by ING Bank to resolve this matter with the United States is $619,000,000.00, an amount equivalent to 8.5 percent of ING Bank’s net profits in fiscal 2011 or the price of a 32-year stay at Richard Branson’s private 74-acre luxury Caribbean retreat on Necker Island (at $371,000/week, plus tips).

The bank pledged major changes in the conduct of its business in the areas of policies, software, training and compliance programs, as well as closing offices in certain countries. Although the total cost of such actions has not been made public, it is safe to assume it was an expensive exercise, adding further to the $0.6 billion ING Bank paid to the American government. The total cost of this remarkable failure in correspondent banking and trade-finance risk management will never be known to outsiders.

According to a report from Thomson Reuters, an ING spokesperson stated that “disciplinary actions including terminations and forced early retirement against more than 60 employees” had been undertaken by the bank. American authorities, however, have not yet made public any intentions on prosecuting individual bank employees.

To many market observers, punishing shareholders by reducing profits rather than launching criminal prosecutions of bankers flagrantly violating the law makes a farce of regulatory oversight. Given the recent past and present economic climate, it is likely that this regulatory action will further inflame tempers and push ill-informed politicians into the fray — not the ideal solution to a complex problem.

ING Bank’s expensive settlement was largely a result of “stripping,” the practice of removing or substituting information contained in payment or trade finance instructions in order to prevent association of the transaction with a sanctioned entity – person or corporation – or country.

Payments in U.S. dollars (USD) for international banks operating outside the United States must be handled by a correspondent bank in the United States. Nostro and Vostro accounts are debited and credited based on transactional activity between banks based on the currencies involved and the underlying transactions, whether they are related to straightforward payments, international trade or portfolio investment flows.

In this case, the American government spent considerable time examining certain correspondent banking and international trade finance activity of ING Bank, namely:

Settlement ghosting

ING Bank’s operation on the Caribbean island of Curacao would handle settlement instructions for USD payments on behalf of Cuban exporters, but it would not make reference to the Cuban beneficiary; instead, it would use an internal reference number identifiable only to ING Bank in Curacao. For outgoing SWIFT MT103 messages from ING Bank’s Cuban business, field 50 would be not include the name of the Cuban applicant but rather the name of the ING Bank branch handling the payment, or in some cases, the name of the branch itself. [Editor’s Note: A SWIFT payment involves the use of a highly-specialized and secure messaging service to an institution, either in the United States or overseas. It is an acronym for Society for Worldwide Interbank Financial Telecommunications.]

As a result, the payment applicant’s instructions would describe a USD payment, routed through ING Bank’s correspondent bank in the United States with no reference to a Cuban beneficiary, and therefore unlikely to trip automated warnings within the USD correspondent bank’s payments systems.

SWIFT message shopping

ING Bank in Curacao would employ a SWIFT MT202 cover payment message instead of an MT103, as the MT202 would not need to include the originator nor beneficiary information, convenient for when Cuban entities are transacting in USD. SWIFT undoubtedly will be less than pleased finding out their rules were bent to bypass sanctions regulations. An international bank connected to SWIFT can run into significant reputational risk problems if its MT202 cover payments messages require enhanced due diligence by others.

Corporate account nesting

When mitigating the risks of money laundering in correspondent banking activity, one must be careful to ensure one bank does not “nest” its transactional activity in another bank’s regular course of business. In the case of ING Wholesale Banking’s branch in the Netherlands, they nested transactional activity by Cuban companies sanctioned by the United States into corporate account activity by a non-sanctioned corporate entity. They even named this process the use of “a special purpose front office.”

Back-to-unknown letter of credit

A back-to-back or transferable letter of credit is employed by a trading company to prevent the exporter from dealing directly with the importer and cutting out the middle man. In 2003, Bank Tejarat of Iran, the third largest bank in the country, issued a letter of credit for the purchase of an aircraft engine from a firm in the United States.

ING Bank’s Romanian branch followed Bank Tejarat’s amendment instructions to scrub the transferable letter of credit of all information related to the Iranian importer and to change the final destination of the goods from Iran to Germany. Both banks knew that if the transaction contained information on the actual purchaser in Iran, the American side would run afoul of economic sanctions.

Judging from the information contained in the Settlement Agreement, it would appear that the advising bank in the United States flagged the transaction and contacted the second issuing bank, ING Bank’s Romanian branch, about further details on the first issuing bank (Bank Tejarat), the importer and final destination. Such flagging could have been an automatic trigger within the advising bank’s AML systems (perhaps due to perceived Romanian country risk levels) or the simple policy of requesting the details of the first transactional leg when processing the second leg of a back-to-back letter of credit.

When an employee of ING Bank’s Romanian branch informed the American advising bank that the first issuing bank was Bank Tejarat of Iran, the transaction was flagged and reported to OFAC.

The techniques noted above all touch upon the techniques of money laundering within correspondent banking and trade-based money laundering, as the proceeds from country sanctions violations routed to the transaction’s beneficiary by mechanisms that disguise origins and lend a veneer of legitimacy to the transaction by financial professionals can be construed as money laundering.

Using the above tactics to evade American law takes time, patience and a coordinated approach by an extensive network of people within a major international financial institution. If large elements of a bank’s sales, operations, risk management and legal counsel act in concert to subvert the country sanctions, the bank’s compliance culture is tragically flawed and prone to place shareholders, directors and unsuspecting employees at risk.

To avoid settlement payments and enforcement agreements whose sum cost rise into the billion-dollar range, international banks must instil a compliance culture within their international trade sales and processing businesses, along with the same within the payments centre and the correspondent banking division.

ING Case

http://blogs.reuters.com/financial-regulatory-forum/2012/07/16/learn-the-compliance-lessons-from-an-epic-fail-in-correspondent-banking-and-trade-finance/